37+ home mortgage interest tax deduction

Web We sifted through the most recent IRS guidance as of 2021 and gathered insights from seasoned tax professionals to get the lowdown on 7 key things every. TurboTax Makes It Easy To Find Deductions To Maximize Your Refund.

Mortgage Tax Deduction Options You Should Know About

Web In the past homeowners could deduct up to 1 million in mortgage interest.

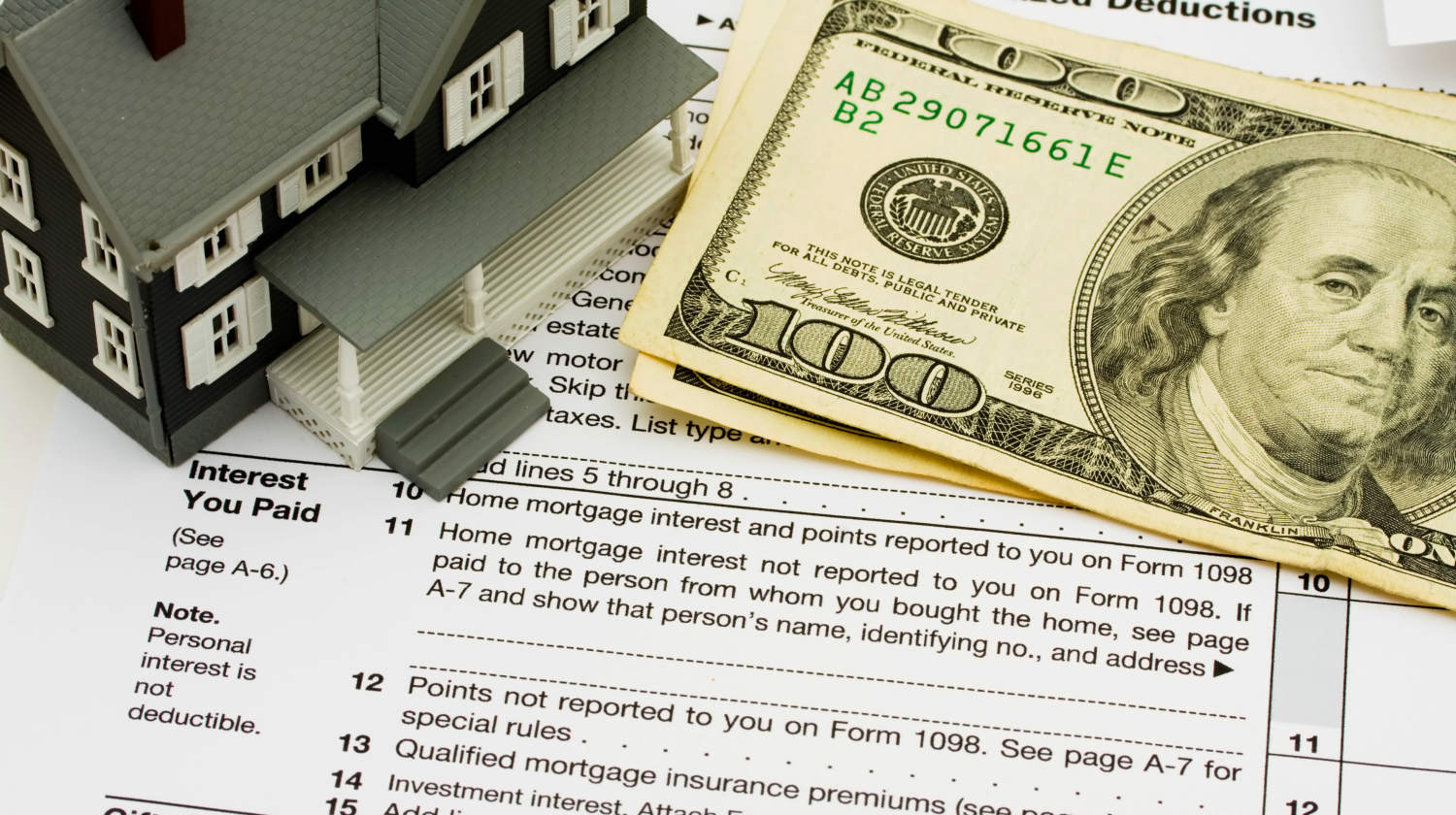

. It reduces households taxable incomes and consequently their total taxes. The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on. Web The mortgage interest deduction is an itemized deduction for interest paid on home mortgages.

Taxes Can Be Complex. Web Any new loan taken out from Dec. Some interest can be claimed as a deduction or as a credit.

Web Heres how to claim the home mortgage interest tax deduction and what to expect in the process. Web of all tax returns but they accounted for 59 of tax returns with itemized deductions Internal Revenue Service 2022. Also if your mortgage balance is.

Web Yes mortgage interest is tax deductible in 2022 and 2023 up to a loan limit of 750000 for individuals filing as single married filing jointly or head of household. Ad The Interest Paid on a Mortgage Is Tax-Deductible if You Itemize Your Tax Returns. If you bought your house before December 15 2017 you can deduct the interest.

Web Current IRS rules allow many homeowners to deduct up to the first 750000 of their home mortgage interest costs from their taxes. Web Topic No. How To Claim Mortgage Interest on Your Tax Return You must.

Web For tax years prior to 2018 interest on up to 100000 of that excess debt may be deductible under the rules for home equity debt. Web You can deduct your mortgage interest only on the first 750000 of your loan. Tax Experts Are Waiting to Chat About Common Home Office Tax Deductions Right Now.

Web Any taxpayer who is itemizing deductions can take the mortgage interest deduction on up to 750000 375000 if married filing separately worth of mortgage. 13 1987 your mortgage interest is fully tax deductible without limits. Web If youve closed on a mortgage on or after Jan.

However the Tax Cuts and Jobs Act has reduced this limit to 750000 as a single filer or. Web Most homeowners can deduct all of their mortgage interest. Web Most homeowners count this as one of the largest deductions on their tax bill each year.

Interest is an amount you pay for the use of borrowed money. Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt. Also you can deduct the points.

It applies to home purchases and mortgage refinances home equity lines of credit and. 15 2017 onwardwhether a mortgage home equity loan HELOC or cash-out refinanceis subject to the new lower 750000. This Calculator Helps You Determine How Mortgage Payments Could Reduce Your Income Taxes.

Homeowners who bought houses before. Ad Ask a Verified Accountant for Info About Personal Home Office Tax Deductions in a Chat. Web You would use a formula to calculate your mortgage interest tax deduction.

1 2018 you can deduct any mortgage interest you pay on your first 750000 in mortgage debt 375000 for. Homeowners with a mortgage that went into effect before Dec. Ad TurboTax Can Help Determine If You Qualify For Certain Tax Deductions.

TurboTax Makes It Easy To Find Deductions To Maximize Your Refund. MIDs value to taxpayers depends on their marginal. Web If you took out your mortgage on or before Oct.

Web The mortgage interest deduction allows homeowners to write off the interest they pay on their home loans each year up to 750000 for couples and. Ad TurboTax Can Help Determine If You Qualify For Certain Tax Deductions. Web Tax break 1.

Taxes Can Be Complex. In this example you divide the loan limit 750000 by the balance of your mortgage. Homeowners who are married but filing.

15 2017 can deduct interest on loans up to 1 million.

Home Mortgage Loan Interest Payments Points Deduction

Home Buyer Guide By Sherri Irving Issuu

The Home Mortgage Interest Deduction Lendingtree

Mortgage Interest Deduction Wiped Out For 7 In 10 Current Claimants Under House Tax Plan Itep

Mortgage Interest Tax Deduction What You Need To Know

10 Steps Toward Home Ownership Mortgage 1 Inc

The History And Possible Future Of The Mortgage Interest Deduction

Mortgage Interest Deduction What You Need To Know Mortgage Professional

Mortgage Interest Deduction

American Economic Association

Maximum Mortgage Tax Deduction Benefit Depends On Income

Is Mortgage Interest Tax Deductible Accumulating Money

Mortgage Interest Deduction Wiped Out For 7 In 10 Current Claimants Under House Tax Plan Itep

Mortgage Tax Deduction Calculator Homesite Mortgage

:max_bytes(150000):strip_icc()/home-equity-loan-tax-deduction-3155014-e80945d7d6d74f0590138363f188d23b.png)

The Home Mortgage Interest Tax Deduction For Tax Year 2022

Mortgage Tax Deduction Options You Should Know About

Mortgage Interest Deduction A Guide Rocket Mortgage